Navigating the Seas of Leveraged Investing: TQQQ Stock Price Forecast

Updated Aug 30, 2024

In high-stakes investing, the allure of leveraged ETFs like TQQQ is undeniable. These instruments, designed to amplify the daily returns of their underlying benchmarks, offer a siren call to those seeking to maximize gains in bull markets. Yet, as with any potent financial tool, the key to harnessing their power is a strategic approach acknowledging their potential and pitfalls.

TQQQ, for instance, seeks to deliver thrice the daily performance of the NASDAQ-100 Index. While this can result in outsized gains during an upward trend, it’s crucial to understand that this leverage also magnifies losses, and the impact of volatility decay can erode profits over time. This phenomenon becomes more pronounced during periods of market turbulence, where the compounding of daily returns can diverge significantly from the long-term performance of the index.

However, TQQQ is not the only arrow in the quiver for those with an appetite for aggressive strategies. For example, buying call options on QQQ can offer a different avenue for leveraging market movements. Opting for calls with 12 months or more until expiration—often called LEAPS—can mitigate some risks associated with short-term options trading. These longer-dated options provide the benefit of time, allowing the underlying asset more opportunity to move in the desired direction, thus potentially reducing the impact of time decay and daily market volatility.

TQQQ Forecast For 2024

Mastering Aggressive TQQQ Strategies: A March 2024 Perspective

The current market sentiment as of April 2024 is somewhat bullish, yet the undercurrents suggest caution. The NASDAQ’s ascent is primarily attributed to a select group of stocks, often called the “Magnificent 7,” hinting at a narrow leadership driving the index upward. This concentration raises a flag, as a broad-based rally is generally more sustainable.

The McClellan Summation Index, a tool to gauge market breadth, has not confirmed the recent highs, which could be a precursor to a divergence, suggesting that the bullish sentiment might be on shaky ground. With sentiment indices trading above the 50 range, there’s an air of optimism, but it’s tinged with the awareness that market reversals could occur swiftly, especially given the current elevated levels.

A potential cooling-off period, such as the S&P 500 retracting to the 4700-4800 range, could serve as a healthy correction, providing a solid foundation for future gains. However, without a broader participation in the rally, as indicated by the number of new highs above their 200-day moving average and a confirmation from the McClellan Summation Index, the market may face a steeper pullback, possibly around 2025.

Price action remains the primary indicator, suggesting that any near-term pullbacks could present buying opportunities. Astute investors might consider this a strategic moment to observe and wait for the S&P 500 to reach the aforementioned levels before increasing their stakes in TQQQ. This approach aligns with a disciplined investment strategy, balancing the pursuit of high returns with a measured response to market indicators.

We’ll examine this topic through the lens of events in 2020, concluding with our current perspective as of March 2024. This historical context validates our actions and underscores the value of learning from history to prevent repeating past errors. In stock markets, a pivotal lesson is that crashes offer buying opportunities—a principle central to our message at Tactical Investor since 2003.

TQQQ Stock Price Forecast

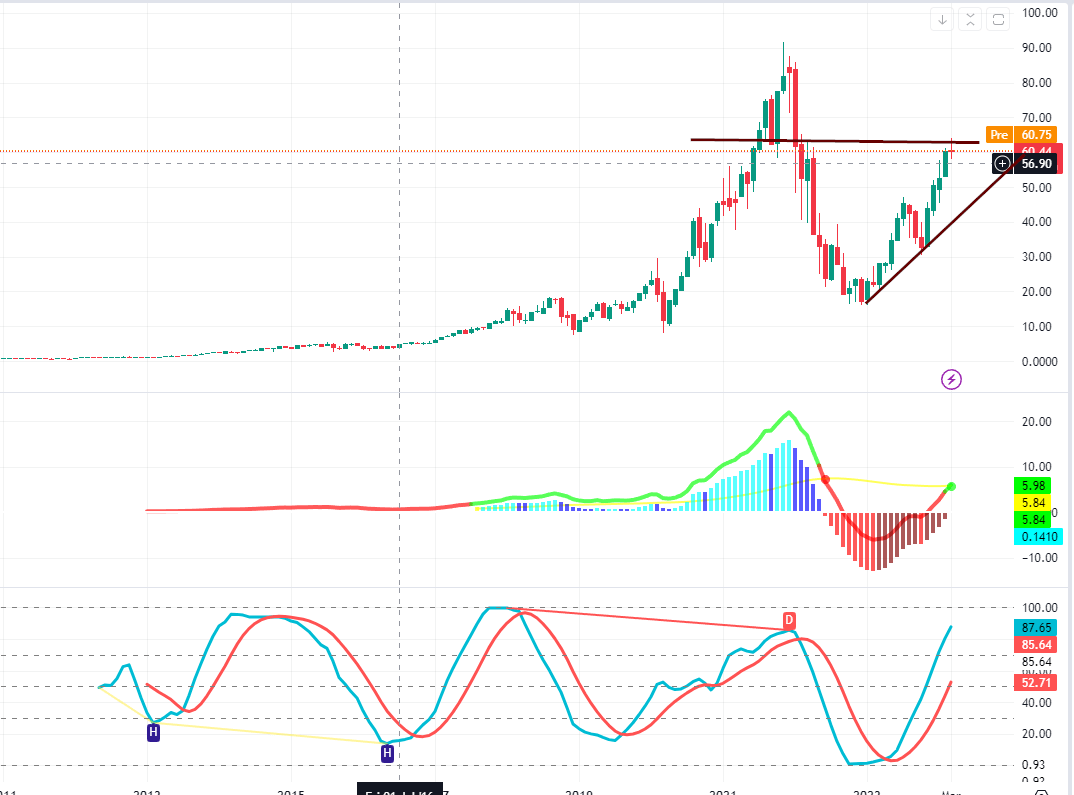

The observed pattern here is quite intriguing. It typically involves surges to new highs when the MACD indicators are trading in overbought territories (which aren’t displayed in the chart above). Afterwards, there’s a retracement followed by an attempt to retest previous highs before experiencing a more substantial pullback. If this pattern (highlighted with “if”) repeats itself, after testing its highs, we can anticipate a pullback to the 63 to 66 range, possibly even dipping as low as the 54 range.

However, it’s essential to consider that, unlike the significant pullback between May 2018 and December 2018, TQQQ is currently trading in the highly oversold territory on the monthly charts (as depicted below). Consequently, under normal circumstances, the intensity of the pullback would likely fall into the mild to medium categories. On the other hand, there’s a possibility that TQQQ might shed its excess weight in one substantial move. Regardless of the outcome, the crucial factor is that our indicators need to retreat from the overbought ranges on the weekly charts.

We will be closely monitoring TQQQ and several other leveraged ETFs as we plan to replace a significant portion, if not all, of the plays in the Moderate to High-risk portfolio’s secondary candidate category with closely monitored leveraged ETFs. As previously mentioned, the strategy will revolve around playing intermediate timelines by closely following the developments on the weekly charts. We will use the weekly charts as our guide for entering and exiting these leveraged plays.

This is another trend that subscribers should pay attention to; this bull market is unusual in that, it’s being powered by B.S. As we stated from the onset of this bull; hot money is the only factor that is keeping this bull alive. Market Update Jan 19, 2020

Aggressive Investment Strategies for TQQQ

Dollar-Cost Averaging (DCA): Regularly investing a set amount into TQQQ can mitigate the impact of volatility. By consistently purchasing shares, investors buy more when prices are low and less when prices are high, potentially reducing the average cost per share over time.

Hedging with Inverse ETFs: To counterbalance TQQQ’s inherent risks, investors might use inverse ETFs like SQQQ. This strategy can help manage losses during market downturns but requires vigilant monitoring due to the potential for rapid price changes in both ETFs.

De-Risking: Investors may decrease their TQQQ holdings as they achieve financial goals, secure profits, and reduce exposure to future market downturns.

Diversification: Despite TQQQ’s potential for high returns, diversifying investments is essential. Balancing a portfolio with a mix of assets can spread risk and enhance stability.

Active Monitoring: TQQQ is designed for short-term investment strategies due to its daily leverage reset. Investors should actively monitor and adjust their TQQQ positions to align with short-term market movements and avoid the compounding effects of volatility over extended periods.

Conclusion: Mastering Aggressive TQQQ Strategies

The historical landscape since 2020 underscores the cyclical nature of markets, with downturns often presenting attractive entry points. TQQQ, a leveraged ETF targeting threefold daily returns of the NASDAQ-100, embodies a high-stakes investment choice. Historical trends suggest that significant pullbacks may follow sharp rises in TQQQ, and the concept of an ‘oversold’ market adds a layer of complexity, indicating that each pullback could unfold uniquely.

A strategic approach to TQQQ involves vigilant oversight, with an eye on leveraging weekly chart analyses to inform timely entries and exits in sync with prevailing market trends. The bull market’s speculative undercurrent warrants a degree of caution. Yet, TQQQ’s core holdings in AI and tech sectors signal a strong position for those with a high-risk appetite. For investors averse to leverage, QQQ offers a non-leveraged alternative.

Effective TQQQ investment demands a blend of strategies: dollar-cost averaging, hedging with inverse ETFs, strategic de-risking, portfolio diversification, and constant market surveillance. These methods aim to harness TQQQ’s potential for substantial returns while managing the amplified risks of leveraged ETFs.